Budgeting can be a very daunting task. The best advice that I can give you is to keep it simple. The Dave Ramsey Budget percentages method is one of the best-recommended and simple methods for budgeting.

The budget percentages method just divides your expenses into categories and assigns percentages to each one.

It is a great method to use if you are new to budgeting and you aren’t sure what an appropriate amount to spend in each category is.

It’s where I started when I first learned to budget.

What is The Dave Ramsey Budget Percentages?

It’s a budget plan that allows you to allocate your money into categories and assigned percentages to them. Categories such as food, utility, housing, and transportation to name a few. You are in charge, telling your money where to go and how to be spent.

Creating the budget is the first step, everything after that becomes easier.

Just stick to it and you will be seeing results immediately.

Just remember this is YOUR budget and it’s unique to your household.

You can assign any percentage to any category.

Make it your own!

I first started tracking my expenses in 2010, after my house flooded and I got into so much debt.

I had to do something about paying off my debt and decided to get serious about my budget.

That’s when I found Dave Ramsey’s budget percentages guidelines.

I immediately went to town by creating a budget.

I made a few tweaks and adjustments here and there as the weeks went by.

But after a few weeks, I was holding strong.

I was so motivated just seeing how I was able to stick to the budget and as a result, I had money to start paying off my debt.

In the first few weeks, you are going to become familiar with your spending habits by tracking everything. This is key!

As you become more aware of where your money is going you will be able to set better allocation percentages into your categories.

Dave Ramsey Budget Categories

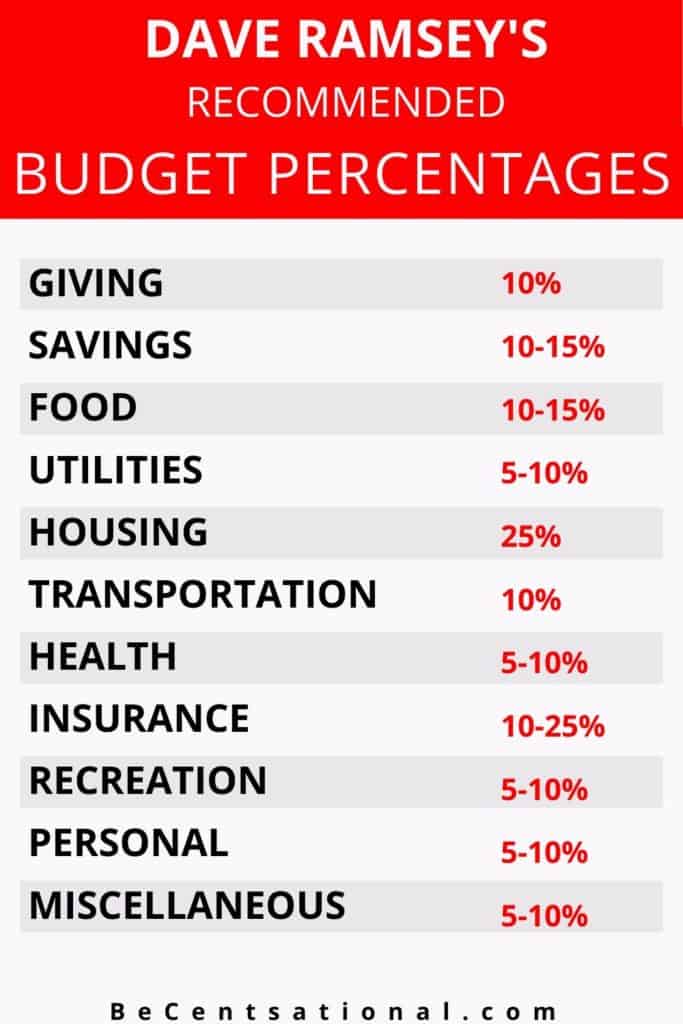

Dave Ramsey percentages has 11 categories and has allocated a percentage to each.

- Giving – 10%

- Saving – 10-15%

- Food – 10 to 15%

- Utilities – 5 to 10%

- Housing – 25%

- Transportation – 10%

- Health – 5 to 10%

- Insurance – 10 to 25%

- Recreation – 5 to 10%

- Personal Spending – 5 to 10%

- Miscellaneous – 5 to 10%

Breakdown of Budget Percentage with Descriptions

Let’s take a more detailed look with what goes in each category according to Dave Ramsey percentages.

Giving (10%)

Giving a tithe or to charity is very common.

These expenses are tax-deductible.

Savings (10-15%)

Dave recommends allocating 10-15% of your income in savings.

Savings recommendations:

- Emergencies

- Big Purchases

- Retirement

You can start by building an emergency fund.

Also, you can always set money aside by contributing to a 401k retirement savings plan.

If your employer does not offer a retirement plan you can always save in an IRA.

The money you put into the retirement plans is pre-tax.

By contributing to your 401k or IRA you will reduce your taxes and may even receive a tax refund.

Start investing in your retirement NOW. Your future self will take you!

Food (10-15%)

Food is a necessary expense. Eating in, eating out or just buying groceries or cooking at home is on Dave Ramsey’s food budget recommendation.

Let’s be real here. This is one of the hardest parts of the budget.

I mean, when you get home after a long day at work you are already exhausted.

All you want is order take-out and have a few minutes to yourself to relax.

Or for the stay at home moms and dads, after a long day playing ‘driver’.

Taking the kids to and from school and driving them around to all the extracurricular activities.

I mean…. uuuffff I am just tired thinking about it.

But with all that been said, managing your grocery budget is all about saving yourself precious time but most importantly money.

The key here is to plan ahead! These frugal meals and cheap foods would help stretch your food budget.

Also if you are short in time these recipes are simple to make and can be done in 30 minutes or less.

Relate Post:

Utilities (5-10%)

Your utilities include electricity, water, gas, trash services, and heating costs.

I will also add in this day and age the internet, cable, and mobile costs.

You can save money on your utility budget by being vigilant and using some saving tips on the usage of electricity and water.

Housing (25%)

Housing is the largest expense in household budgets in the US.

Dave Ramsey’s budget percentages encourage you to allocate no more than 25% of your take-home pay to housing.

This is hard specially if you live in a hight cost of living city, like New York, San Francisco, Chicago, London, Amsterdam, Etc.

If you live in a high COLA city do the allocation that applies to you.

The housing category includes:

- Mortgage payments or rent

- Property taxes

- PMI (when applies)

- Maintenance

- Homeowners association fees (HOA)

- Insurance

- Taxes

Transportation (10%)

The Transportation category includes:

- Gas/fuel

- Oil changes

- Toll fees

- Public transportation (buses, trains, ferries)

- Parking fees

- Car tag renewals

- Uber/Lyft/Taxis

Health (5-10%)

We all need to be proactive and plan for sickness and unexpected doctor visits that may not be covered by insurance.

These health expenses adds up quickly. They can be expenses like prescriptions, copayments or simply over the counter medications.

The good news is that we can save money for health costs with an HSA or an FSA.

The money we put into these accounts is pre-tax.

Insurance (10-25%)

The insurance category includes:

- Health insurance

- Auto insurance

- Homeowner’s or renter’s insurance

- Life insurance

- Disability insurance

Recreation (5-10%)

This is the part of the budget where you get to do FUN things.

- Concerts

- Movies

- Picnic in the park

Personal Spending (5-10%)

Here is when you set money aside for personal things.

I am a big proponent of self-care and this is the category to allocate my self-care expenses.

- Haircuts

- Clothes

- Shoes

- Back to school thing for the kiddos

Miscellaneous (5-10%)

When I first saw this category in the budget, I was like “Miscellaneous??? for WHAT???

Well… I learn pretty quickly that the miscellaneous category has a place in every budget.

I was on my way back from the laundry area with all my freshly washed and folded clothes on the basket. Guess what?? the bottom of the basket just came off.

I had to buy a new replacement. I immediately realized in which category this one-off item will fit in. “The miscellaneous” YUP!

I call it the Miscellaneous/Discretionary category. This is where I put birthday gifts, father/mothers day gifts, etc

In closing, do not lose sight of your goals. Stay true to your budget. There will be months that you will be over budget. But don’t let that discourage you.

You will see that most of the time you are either withing budget and at the times even under budget.

These are the times when you get super excited and pumped.

Use this to keep the momentum and put more money towards your savings.