What The New W-4 Form Means for You

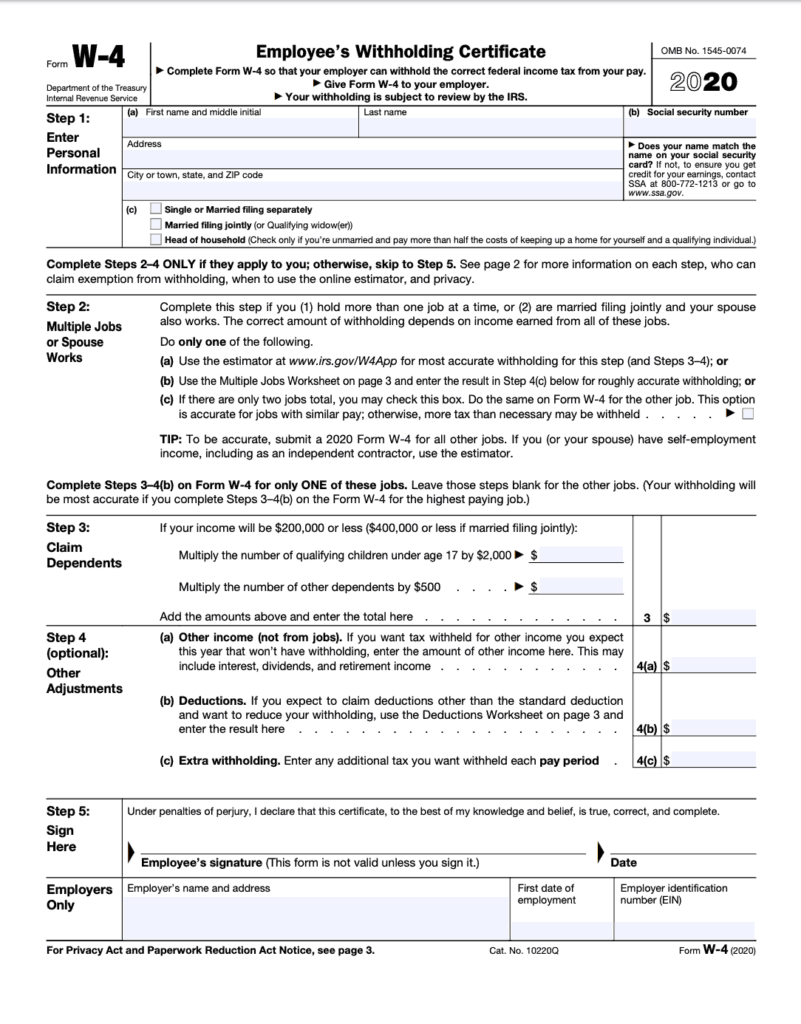

As you have likely heard or read on the news, the IRS has released a new redesigned W-4 form for 2020. The most notable changes are the removal of W-4 allowances and the worksheets, which have been replaced by a series of questions.

Also, some of the filing categories have been changed as well.

The purpose of the W-4 form is to let your employer know how much tax should be withheld from your paychecks.

I will be showing you how to fill out and complete the newly redesigned W-4 form.

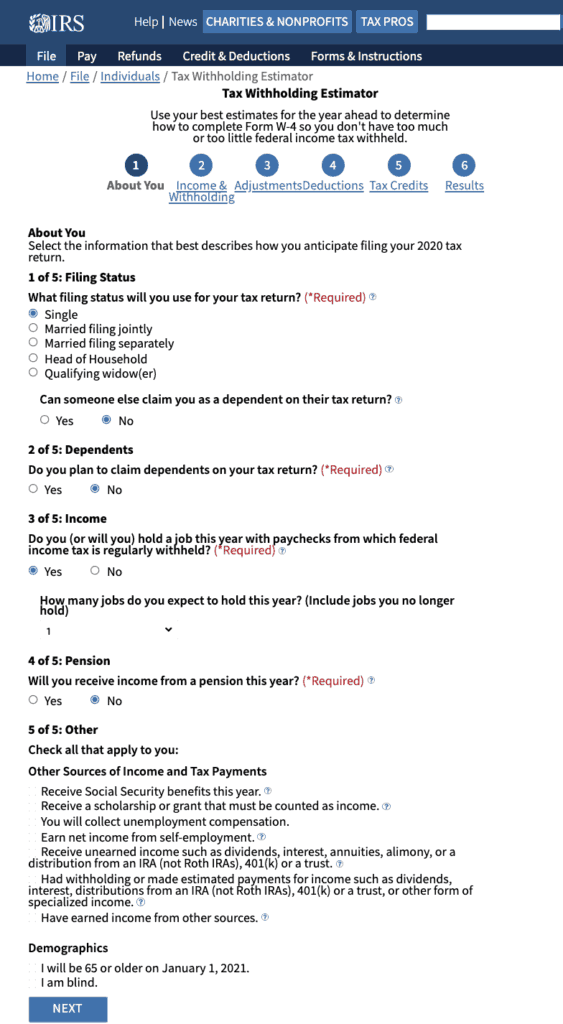

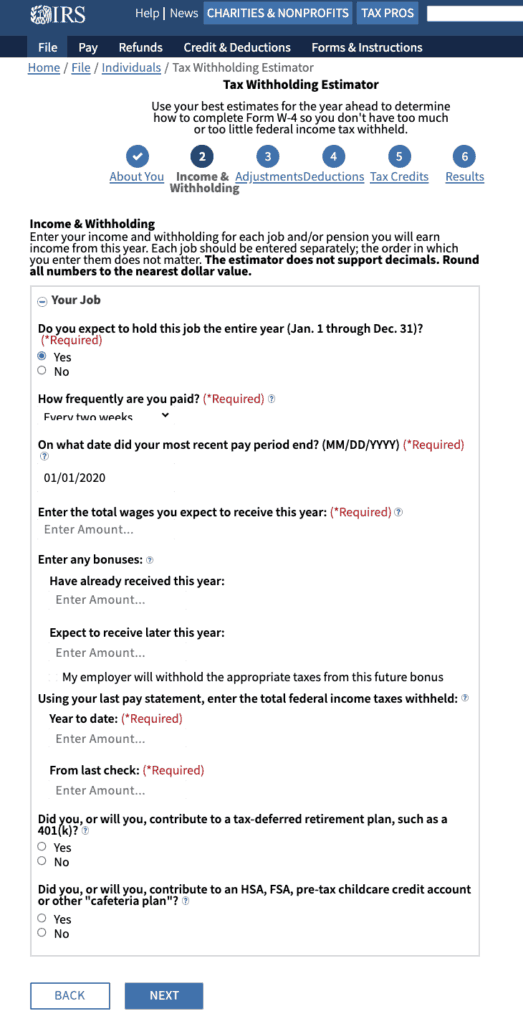

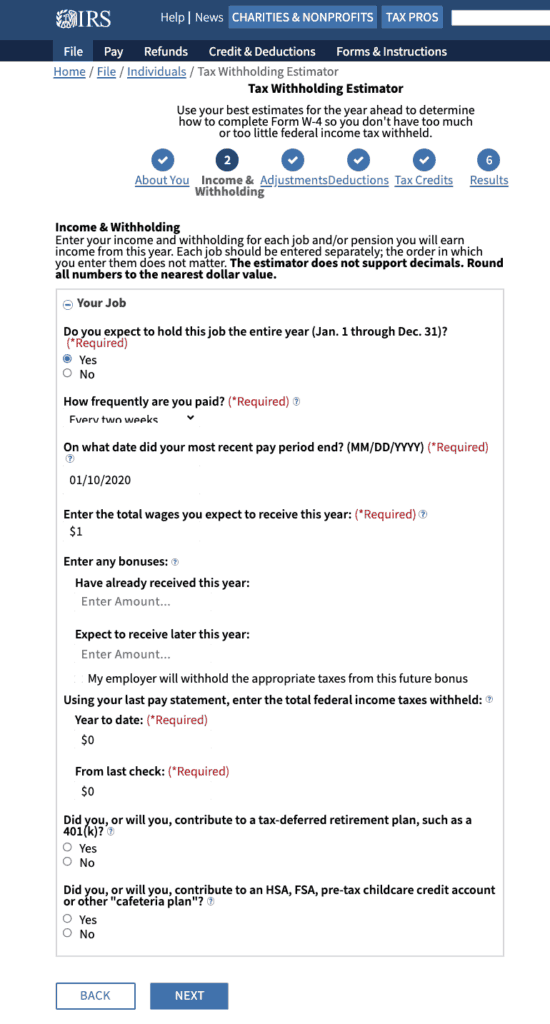

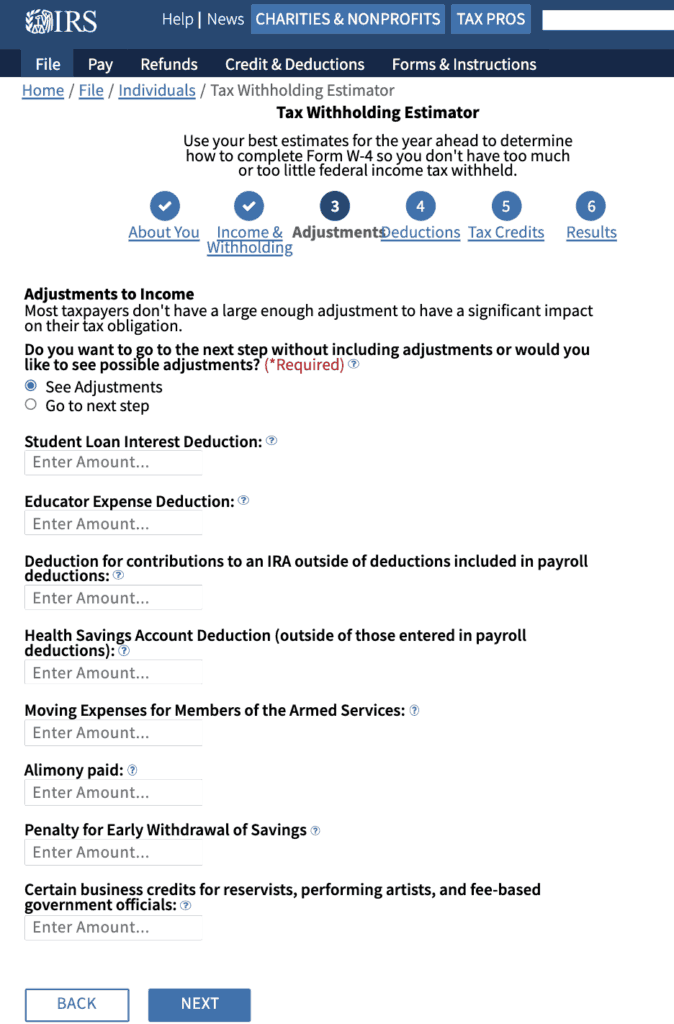

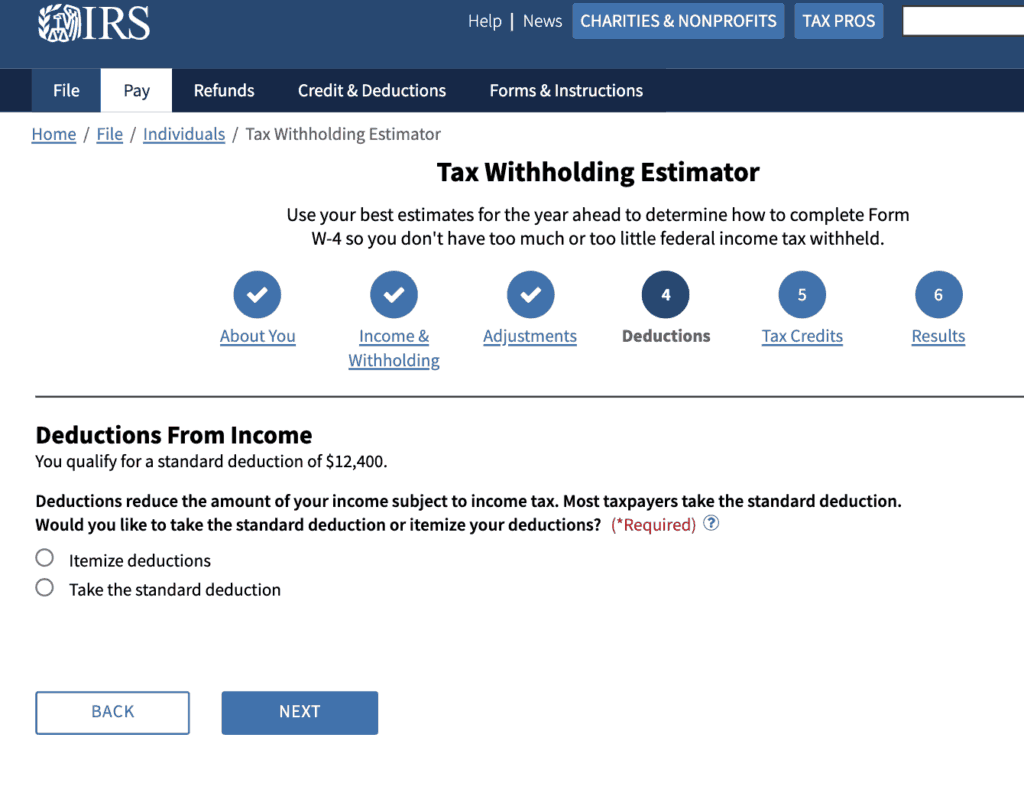

I will be showing you as well a step by step guide with pictures on how to perform a “Paycheck Checkup” using the Tax Withholding Estimator.

Here’s everything you need to know about the new form, how to fill out and completed and how to use the calculator tool.

This is a revised form as per the IRS

Where Can You Download The New W-4 Form?

The new W-4 form (Employee’s Withholding Certificate) can be downloaded at the IRS website

Should You File a New W-4 in 2020 Even if I Don’t Have To?

No, you are not required to file the new updated W-4 form.

However, If you were employed prior to the year 2020, your employer already has on file the old W-4 form claiming allowances.

If you want to change your withholding only then you will have to complete and file the new W-4.

You should file a new W-4 form if you want to have less or more money withheld from your paycheck.

I strongly suggest that if you get a tax refund you should save at least some of that money.

Perhaps start saving and building an emergency fund.

Related Posts:

Have no Savings? Simple Steps You Should be Taking Now

Is Everyone Required to File a New W-4 Form?

Not at all. Not everyone is required to complete the new W-4 form.

However, if you are starting a new job in 2020 you must complete the newly redesigned W-4 form.

Since you are already working together with your HR department filling out the W-4 form don’t forget to also sign up for your employer’s 401k retirement plan.

But if you were employed before the year 2020, and want to have your withholding adjusted from your paycheck, you too will have to fill out the new redesign W-4 form going forward.

Why Would You Change Your Withholding?

It is not necessary or mandatory to change your withholding if you are already in employment before the year 2020.

But I will list some of the most common reasons why you would want to change the amount of money withheld.

- Getting married

- Getting divorced

- Having or adopting children

- Empty Nest

Related Posts:

Things you Should be Doing to Pay Less Taxes in 2020

How to Fill Out a W4 Form

How to use The IRS Tax Withholding Estimator Tool to Fill Out Your W-4 Form?

The IRS does not require that you file a new W-4 form.

But I strongly suggest that at least you perform a “Paycheck Checkup” using the Tax Withholding Estimator to see if you need to make any changes or adjustments.

This calculator will give you the tools for how to fill out your W-4.

I think it is better to know now than be surprised comes next year tax filing season. Estimate the following:

Enter your most accurate and up to date information to the best of your knowledge into the Tax Withholding Estimator

Related Post:

Should you Claim 0 or 1 Allowances on your W-4 to Lower your Taxes?