Do you know how many allowances you should be claiming on your W-4 for tax purposes? Should you claim 0 allowances, should you claim 1 allowance, or should you claim more than 1 allowances? Are you asking yourself “should I claim 1 or 0”? One of the big changes you can do is adjust the number of allowances you claim on your W-4.

I remember my first job ever. I came into my first day of work, all happy and bouncy.

I met with HR and got handed a folder about 1 inch thick of paperwork I had to fill out.

The poor HR lady must have seen the confusion and horror on my face.

She took pity on me and pull out just a few “essential papers” I needed to fill out on the spot.

One of those forms, the W-4.

Mind you, I had no clue what a W4 was and needless to say what an allowance was.

I vividly remember she asked me “Do you want more money or less money per paycheck”.

I was like “DUH” more money obviously. Who doesn’t?

She told me to write down 2 allowances and sign it.

Little did I know the total number of allowances I was claiming would have huge tax implications for me.

Do you know the total number of allowances you are claiming? If you thinking “How many allowances should I claim” keep reading because I go into details on how to maximizes your taxes by claiming a certain number of allowances.

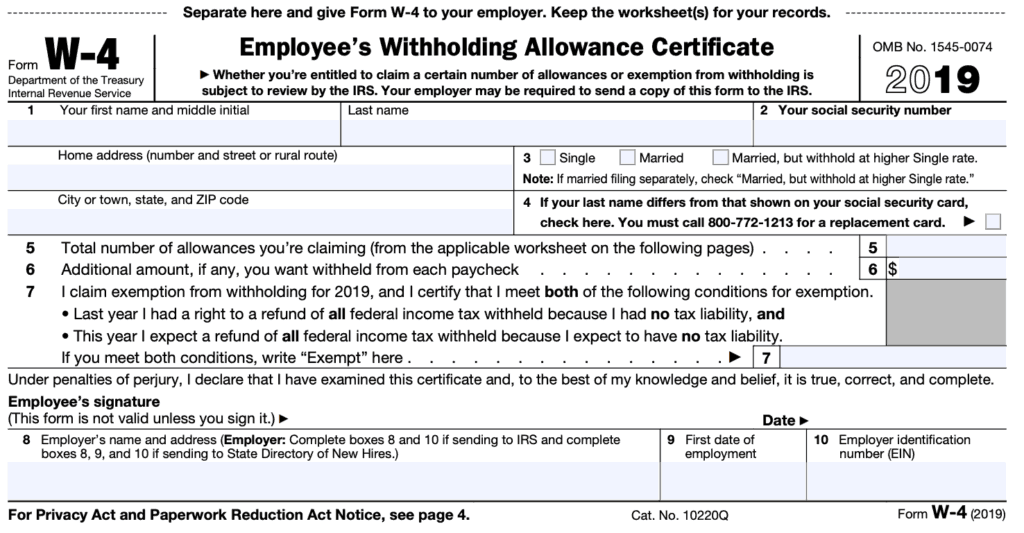

What is a W-4 Form?

The Employee’s Withholding Allowance Certificate is most commonly know as a W-4. It is an Internal Revenue Service (IRS) tax form that a person (employee) fills out to let the employer know how much taxes should be withheld from their paycheck.

You can download the form from the IRS website.

A W-4 is a form that every employee has to file.

It is a requirement from the US government.

This is how the employer knows how much federal income taxes should be withheld from your paycheck.

Employers are required by law to report new employees to a designated State Directory of New Hires.

What are Allowances on W4?

W4 allowances are the number of people you are claiming.

The number of allowances determines the amount of money the employer takes out of your paycheck.

More Taxes & Money Saving

- Things You Should be Doing to Pay Less Taxes

- New Redesigned W-4 Form: Complete Guide

- Easy Ways To Spend Less and Save More Money

- Have No Savings? Simple Steps You Should be Taking Now

- What is an Emergency Fund? Easy Tips to Start One

How Many Allowances Should I Claim?

Below is a guide on how many allowances you should claim, depending on your filing status and the number of dependents you claim.

Claiming 0 Allowances

Should you claim 1 or 0 allowances? When you claim 0 allowances your employer withholds the maximum amount of taxes from your paycheck.

Therefore Your take-home pay is going to smaller.

It is most likely that by claiming 0 allowances on your W-4, you will get a big tax refund comes tax-filing season in April.

Claiming 1 Allowance

You can claim 1 w4 allowance if:

- If you are single with one job

- No one else claims you as a dependent

It is likely that if you are single and claiming 1 allowance on your W-4, you will get a small tax refund comes tax-filing season in April.

Claiming 2 Allowances

You can claim 2 w4 allowances if:

- A married couple with no dependents

If you are married and claiming 2 allowances on your W-4, one for yourself and one for your spouse.

This means you will have less money taken out of your paycheck.

Depending on your total household income you will either get a small tax refund, owe taxes or brake almost even when the tax-filing season comes in April

Claiming 3 or More Allowances

By now you are starting to see that the more allowances you claim the more take-home money you get.

You can claim 3 w4 allowances in the following situations.

- Head of household with one dependent

- A married couple with one dependent

It is always good to review the total number of allowances you are claiming when there is a life change event, such as getting married or having children.

Impact w4 allowances will have on your tax return

| W-4 Allowances | Impact on tax return | Consequences |

| Too few allowances | It is most likely you will get a tax refund | You could have invested that money and earned higher interests. |

| Too many allowances | Chances are you will owe taxes | Might get charged with interest and penalties for underpayments. |

Should I Claim 1 or 0?

Are you asking yourself should I claim 1 or 0 allowances? Claiming 1 or 0, it all depends on your final goal.

Do you want a tax refund? Do you want to break even? or do you want to pay a tax bill to the IRS?

Sometimes we are in a financial situation when we need the money right away.

In this case, it is wise to claim more allowances, so you have more money per paycheck.

How do I know if I should claim 0 allowances?

You may be asking yourself “should I claim 1 or 0“.

If you fall in any of these 2 categories, then it should be beneficial to you to claim 0 allowances.

- If you are claimed as a dependant on someone else tax returns (for example your parents)

- If you are claiming 1 allowance and still owe taxes

What is Withholding?

Withholding is the amount of money taken out of your paycheck.

The money is automatically transmitted to the US government, local states, and social security administration on your behalf.

The purpose of employers withholding money is to reduce the amount of taxes due in April and ensure all US workers are paying their income taxes.

When Should I Increase My Withholding?

You should increase your withholding if:

- you hold more than one job at a time or you and your spouse both have jobs.

- you have income from other sources not subject to withholdings such as interest income, dividends, capital gains, and self employment income.

If you have two jobs or the combined income for you and your spouse is high and you are already claiming 0 allowances, then it is recommended that you increase your withholdings.

You will have too little taken out of your paychecks.

Adjusting your withholdings can be beneficial in these cases because otherwise you may owe taxes and might get charged with interest and penalties.

When Should I Decrease My Withholding?

If you are eligible for income tax credits and/or deductions you should decrease your withholdings accordingly.

The most common tax credits are:

- Child and Dependent Care Credit

- Savers Tax Credit

- American Opportunity Tax Credit

- Earned Income Tax Credit

- Lifetime Learning Credit

The most common tax deductions are:

- Work related deductions

- Health care deductions

- Investment related deductions

- Itemized deductions

- Education deductions

Who Can Claim 0 Allowances?

Can you, on your w4 claim 0? The answer is YES. Anyone can claim 0 allowances.

Just keep in mind that by choosing 0 allowances more money will be withheld from your paycheck.

Can I Make Changes to the W-4?

You can not make changes to a previously filed W-4.

However, you can file a new W4.

It is recommended that you file a new W4 whenever you have changes in your life such as:

- Getting married or divorced

- Start a family having children or adopting

- Starting a second job

- Buying a home

- Start or stop participating in employers benefits

These changes of status can result in your employer withholding too much or too little money.

What is Married, but Withholding at a Higher Rate?

In box #3 of the W-4 form, you will see the marital status choices as follows:

- Single

- Married

- Married, but withhold at a higher Single rate.

Wait…. what? “Married, but withhold at a single rate“.

Now, what is that? Should you choose this box?

If both you and your spouse work and know that every year you have to pay taxes back to the IRS, this is a good option for you.

t is the option that most closely reflects the amount of taxes withheld that a married couple will owe.

your spouse also works and you’re worried about not having enough tax withheld.

What is Additional Withholding on Your W-4?

There are times when even withholding at the highest rate possible (Single claiming 0 allowances), you will still owe a big tax bill in April.

This is when additional withholding becomes the perfect tool to reduce your tax bill.

In addition to the allowances you can claim, you can also request that your employer withhold a certain amount of extra money.

Can I Not File a W-4?

At the end of the day, we all know that Uncle Sam wants his share of your money.

He will get his share whether you file a W-4 or not.

Therefore, if you don’t file a W-4 form with your employer, the IRS requires your employer to withhold at the highest rate.

That would be Single claiming 0 allowances.

How to Pay Less Taxes?

Many people believe it is a great benefit to get a tax return when you file taxes. I am in disagreement with that.

The way I see it is that you overpaid the government for 16 months (the tax year up until the tax filing date (12months+4 months).

It pretty much means you lend the government your hard-earned money interest-free.

You could invest that money to earn your interest in those 16 months.

Not to mention if you keep it invested longer the power of compounding or compound interest.

For example, you can put the money in a high-yielding certificate of deposit, also known as a CD.

With a little tax planning on your part, you should be able to reduce your tax liability.

Start by reducing your taxable income.

The best way to achieve this is by maximizing retirement savings contributions, such as:

- Contributing to a traditional IRA

- Contributing 401k, 403b or 457

- Contributing to an HSA

- Contributing an FSA

By making contributions to retirement savings accounts and other fringe benefits you will be able to lower your adjusted gross income (AGI) and this might even push you into a lower tax bracket.

In conclusion, you need to know the total number of allowances you are claiming.

Also what you need to remember is that generally, the more allowances you claim, the less tax will be withheld from each paycheck.

Therefore you most likely will owe money to the IRS when you file a return and there is the possibility you even owe penalties for underpayment.

On the other hand, the fewer allowances claimed, the larger withholding amount, which may result in a refund when you file a return.

Most Frequently Common Asked Questions (FAQ)

- What’s the difference between claiming 1 and 0? Is it better to claim 1 or 0? It pretty much boils down to if you want to get the extra money on each paycheck or if you want to wait for your refund after filing taxes.

- What happens if I don’t claim enough allowances? If you don’t claim enough w4 allowances you are most likely to get a refund after you file taxes

- How much money will my employer withhold? The amount of money your employer withholds depends largely on how much money you make and how many allowances you claim on your Form W-4.

- What happens if I claim too many allowances? If you claim too many allowances means that your employer withheld too little from each paycheck and you will most likely owe taxes in April when you file your tax return.

- What is my filing status? You have a few options for filing status. Single, Married filing jointly, Married filing separate and, Head of household.

- How many allowances should I claim if I’m Single? If you are filing single you can claim 0 or 1 allowances.

- Am I exempt from tax withholding? You can use the W-4 to claim exempt from withholding. If you had to tax liability in the previous year and don’t expect to owe taxes and receive a refund this year, then you can claim exempt.

- Do I have to fill out a new W-4 each year? No, you don’t have to. Unless you change jobs or have life changes such as children, marriage or divorce.

- What happens if I don’t fill out a W-4? Your employer will withhold the maximum amount of taxes from your paycheck. The result of this is that most likely you will get a big refund.

- Where can I find the W-4 form? You can go to your HR department and request one. Or you can download the W-4 form from the IRS website.

- what if I have more than one job? You either claim all your allowance on job1 or job2 when filing your w-4. Or you can split all your allowance between job1 and job2.

- Is a W4 the same as a W2? No, A w2 tax form shows the amount of money you made in a calendar year and the taxes withheld from your paycheck for that year and is used to file your federal and state taxes.

Are you getting a tax refund? Or on the other hand, do you feel dread each year when it is tax filing season because you know you have to pay back Uncle Sam? If so, are you considering adjusting your w4 allowances and filing a new w4 form with your HR department? Please share your experiences in the comments below.