I gathered a list of the most common investment terms with its definitions.

I know at the beginning all this investing lingo can be overwhelming.

But believe me, it becomes easier as you become more familiar with investing.

Feel more confident and empowered as you learn all these terms and expand your understanding of the investing world.

I want to be able to help you and make your experience reading my post as easy and comprehensive as possible. ENJOY!!

This article contains:

What is an Annuity

An annuity is a contract between a consumer and an insurance company that requires the insurer to make payments to the consumer, either immediately or in the future.

What is Asset Allocation

The process of dividing investments among cash, income and growth buckets to optimize the balance between risk and reward based on investment needs.

What is an Asset Class

Securities with similar features. The most common asset classes are stocks, bonds, and cash equivalents.

What is Appreciation

The increase in the value of a financial asset.

What is a Balanced Fund

Mutual funds that seek both growth and income in a portfolio with a mix of common stock, preferred stock or bonds.

The companies selected typically are in different industries and different geographic regions.

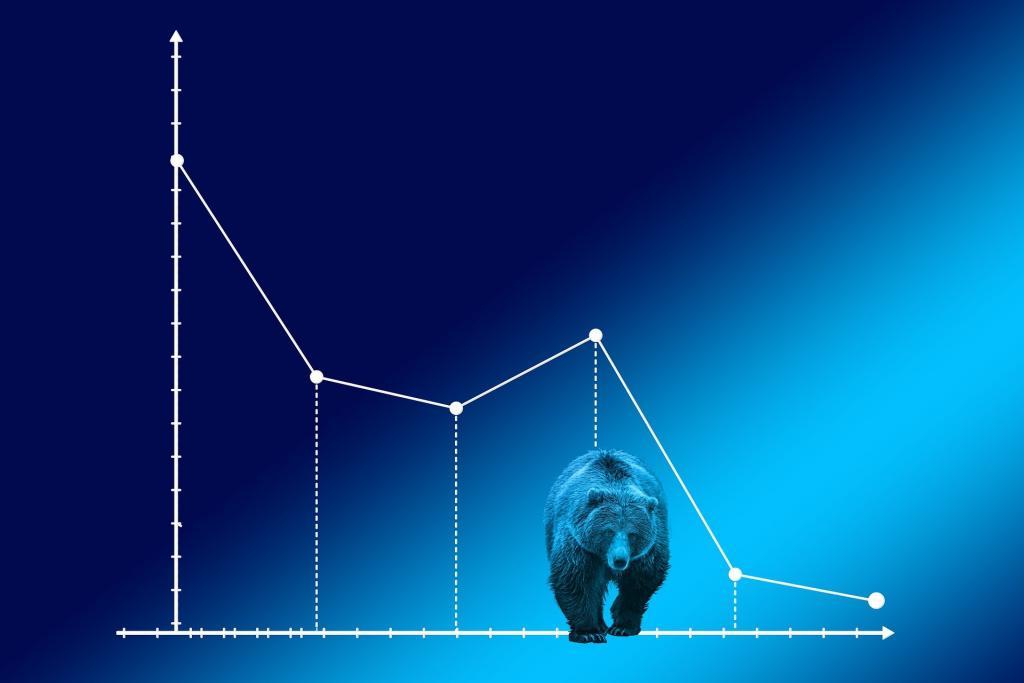

What is a Bear Market

A bear market is a prolonged period of falling stock prices, usually marked by a decline of 20% or more.

A market in which prices decline sharply against a background of widespread pessimism, growing unemployment or business recession.

The opposite of a bull market.

What is the meaning of Benchmark

A standard, usually an unmanaged index, used for comparative purposes in assessing the performance of a portfolio or mutual fund.

What is a Bond Fund

A mutual fund that invests exclusively in bonds.

Investments may include government, corporate, municipal and convertible bonds.

What is a Broker

This is the entity that lets you buy and sell investments for you.

Usually, you pay a fee for this service.

There are also plenty of online discount brokers, where you often pay a flat commission per trade.

What is a Bull Market

Any market in which prices are advancing in an upward trend.

In general, someone is bullish if they believe the value of a security or market will rise.

The opposite of a bear market.

What is Capital Gain

The difference between a security’s purchase price and its selling price, when the difference is positive.

Capital gain is a rise in the value of an investment.

What is Compounding

Compounding is when your earnings get reinvested. The reinvested earnings raise the principal amount, which then earns more money.

Also compounding is known as “Compound Interest.“

What is a Custodian

A bank or financial institution that holds assets, settle all portfolio trades and collects most of the valuation data required to calculate a fund’s net asset value.

What is a Dividend

A dividend is a portion of a company’s profit paid to common and preferred shareholders.

Dividends provide an incentive to own stock in stable companies even if they are not experiencing much growth.

Companies are not required to pay dividends.

In short, a dividend is your share of a company’s profits.

What is Dollar-Cost Averaging

Dollar-Cost Averaging (DCA) is investing the same amount of money at regular intervals over an extended period of time, regardless of the share price.

By investing a fixed amount, you purchase more shares when prices are low, and fewer shares when prices are high.

This may reduce your overall average cost of investing.

What is the Dow Jones

The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange (NYSE) and the Nasdaq. It has been around since 1896!

What is an Equity Fund

A mutual fund/collective fund in which the money is invested primarily in common and/or preferred stock.

Stock funds may vary, depending on the fund’s investment objective.

What are Earnings

That portion of income left over after meeting all costs, overhead and taxes during a reporting period.

This is called the Bottom Line.

When a company is making money, it is said to be “in the black”. When a company is losing money, it is “in the red”.

What is an ETF

Exchange-traded funds (ETF) are like mutual funds, except that they trade throughout the day on stock exchanges as if they were individual stocks.

These ETFs can hold various assets like stocks, commodities, or bonds.

What is Expense Ratio

It costs money to run mutual funds, so investors can expect to pay an annual fee, expressed as the expense ratio.

What is a Hedge Fund

A hedge fund is an aggressively managed portfolio of investments that uses advanced investment strategies with the goal of generating high returns.

What is an Index

A tool used to statistically measure the progress of a group of stocks that share characteristics.

This can include a group of stocks, a group of bonds, or a group of other assets.

What is an Index Fund

An index fund is a mutual fund, that allows an individual to “invest” in an index, such as the S&P 500.

What is Inflation

Inflation is the rising price of the cost of good resulting in a currency losing its value.

Economists typically use the Consumer Price Index, or CPI, to measure inflation.

What is Interest

Is the price you pay for borrowing money or the price you receive for lending money.

Interest is mostly calculated as a percentage.

What is a Large-Cap

The market capitalization of the stocks of companies with market values greater than $10 billion.

What is Liquidity

It is the relative time it takes until an asset is converted into cash, or the payment of liability is due.

The ability to convert an asset into cash.

What is a Market Correction

A negative movement of about 10% or more in a stock, bond, commodity or index to amend an overvaluation, interrupting an uptrend in the market or an asset.

Generally, a temporary price decline of a shorter duration than a bear market or recession, although it can herald both

What is a Maturity

The date specified in a note or bond on which the debt is due and payable.

What is the NYSE

The New York Stock Exchange (NYSE) is a stock exchange located in New York City that is considered the largest equities-based exchange in the world and is made up of 21 rooms that are used to facilitate trading.

What is NASDAQ

This is the marketplace for buying and selling securities.

There are thousands of stocks listed on the Nasdaq exchange that includes giant companies like Apple, Google, Microsoft, Oracle, Amazon, and Intel.

What is Rebalancing

The act of returning a portfolio to its original asset allocation.

Rebalancing keeps a portfolio in line with its original investment objectives and risk levels.

What is Risk Tolerance

A person’s capacity for how much risk they are willing or able to withstand for a possibly larger reward.

What are Securities

Securities is any financial asset that can be traded. Securities include stocks, bonds, and bank deposits.

What is a Stock

A stock is simply a small piece of a company.

A long-term, growth-oriented investment representing ownership in a company; also known as “share” or “equity.”

What is a Small-Cap

Small-Cap is a term used to classify companies with relatively small market capitalization.

The market capitalization of the stocks of companies with market values less than $3 billion.

What is Volatility

This is when there are big swings in either direction of the stock market or individual stocks.

If the stock market rises and falls more than 1% over a consistent period of time, it would probably be considered a ‘volatile’ market.

What is Yield

This is associated with dividend investing.

Your yield represents the ratio between the stock price paid and the dividend paid.

What is YTD

Year-to-date return on investment including appreciation and dividends or interest.

You may enjoy these other posts:

- GUIDE TO TRADITIONAL IRA

- SIMPLE WAYS TO REDUCE YOUR ELECTRIC BILL

- 22 SIMPLE WAYS TO SAVE MONEY ON GROCERIES

- HOW TO GET FREE STARBUCKS DRINKS AND FREE REFILLS

Let’s keep adding to this investment term list.